As an independent corporation operating in a highly competitive market, Snowy Hydro decided to pursue Snowy 2.0 as a commercial investment to grow the business.

The following is a high level summary of the business case for Snowy 2.0 and the future NEM conditions and context in which Snowy 2.0 will operate.

Snowy 2.0 will provide reliable, dispatchable energy generation (2,200MW) and large-scale energy storage (175 hours or 350,000 MWh) and builds on Snowy Hydro’s existing capabilities.

Independent economic modelling undertaken by Marsden Jacob Associates (MJA) confirms that the products Snowy Hydro sells in today’s energy market will be in even greater demand in the future, as we transition to a lower-emissions economy.

The market Snowy 2.0 will operate in is one with a higher penetration of intermittent renewables and with progressively retiring thermal generation. Snowy Hydro has modelled Snowy 2.0 for the energy market we’ll face in the mid-2020s onwards, not in today’s NEM which is a mistake that many commentators have made in considering the economics for this project.

MJA and Snowy Hydro’s modelling suggests that the capacity of Snowy 2.0 alone will not be enough to meet the NEM’s demands in the future. From the early 2030s, we expect to need further expansions of the Snowy Scheme (Snowy 3.0 and 4.0) to keep up with the rapidly-changing NEM and the increased requirements for large-scale storage and dispatchable generation.

Overview of Snowy 2.0’s business case

The dispatch-weighted price projections calculated by MJA and on which the Snowy 2.0 feasibility study is based, demonstrate that Snowy 2.0 is not based on a future scenario that is improbable or one in which Snowy Hydro is the only beneficiary.

On the contrary, Snowy 2.0 will limit peak prices and the the risk of extreme price volatility. The risk-management revenue that Snowy 2.0 earns from this (called “capacity revenue”) is roughly 40% of the total projected revenue.

Similarly, the economics of Snowy 2.0 do not rely on crowding out our competitors or making other power producers uneconomic. Quite the opposite: Snowy 2.0 will buy energy from new renewable plants when this energy is surplus to the market’s requirements, store it as water (potential energy) in the upper storage, and release it when electricity demand is high.

The water storage not only turns intermittent wind and solar energy into “firm”, reliable electricity but also protects the NEM from wind and solar droughts – phenomena that are irrelevant in today’s NEM but will be difficult to manage (without large-scale energy storage, such as Snowy 2.0) in the future.

This “firming” capability, added to the revenue earned by pumping, storing and generating, accounts for another 40% of total projected revenue.

The last 20% of the project’s value is provided by ancillary services, grid support and other minor sources that complement the technologies (batteries, open cycle gas plants and renewables) that Snowy Hydro expects to step into the gap left by the retiring coal-fired plants.

Snowy 2.0 is a commercial investment decision by Snowy Hydro

Despite historically having government shareholders, and from July 2018, being wholly owned by the Commonwealth Government, Snowy Hydro operates like any other independent commercial entity competing in an open and fiercely competitive market. We are a company incorporated under the Corporations Act 2001 (Cth) with an independent Board of Directors.

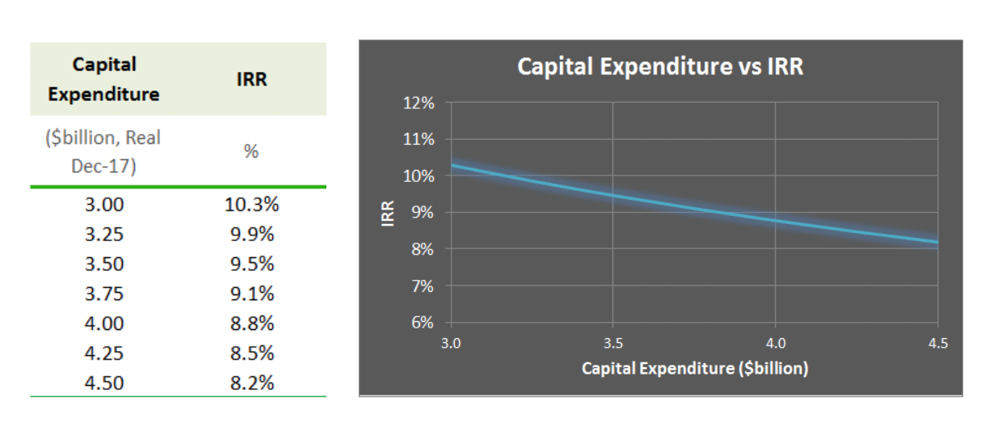

We are pursuing Snowy 2.0 because we expect the project to meet our stringent investment criteria. The internal rate of return (IRR) for the project has been modelled at more than 8%, which is strong for this type of project.

This project was based on the original Snowy Scheme design in the 1960s, but it was not constructed at that time because there was no business case for it due to cheap thermal generation. Fast forward to today and the NEM is changing, with coal-fired generation retiring and more intermittent and variable renewable energy sources coming online, with significant impacts on system stability and reliability.

Snowy 2.0 will underpin the stability and security of the NEM:

• It uses very cheap, large sources of existing energy storage. The levelised cost of storage for Snowy 2.0 is $25-35 megawatt hours (compared with batteries at $195-254 MWh).

• It is centrally located, between the major load centres of Sydney and Melbourne.

• Longevity, Snowy 2.0 will be a 100 year-plus asset while batteries typically need to be replaced every 10 years.

Without Snowy 2.0, the most likely scenario is that a combination of batteries paired with gas and diesel plants would be built to meet the market’s needs. This would cost at least twice as much as the Snowy 2.0 project.

New renewables will be cheaper than new coal generation

Regardless of views on climate policy or the future energy mix, what’s clear is that the cost of building wind and solar (even with a price premium added for ‘firming’ capacity) is cheaper than new coal generation. In the lead up to a final investment decision Snowy Hydro is modelling the new entrant price of a range of generation sources.

Our current modelling shows the new entrant price of new generation (this is the levelised cost of energy) to be the following.

• Wind (including a price premium for firming) is approx $70 – $80 MWh

• Solar (with a price premium for firming) is approx $77 – $99 per MWh

• new HELE coal is approx $78 – $120 MWh depending on capacity factor

• Gas, assuming sufficient quantities can be sourced on existing infrastructure is approx $100 – $125 MWh

Note: Snowy 2.0 does not have a LCOE. It’s a storage project (not new generation). Use levelised cost of storage (against other storage options) for comparison.